employee stock option tax calculator

Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value. The Stock Option Tax Calculator shows the costs to exercise your stock options including taxes based on your companys current valuation.

Simple Tax Refund Calculator Or Determine If You Ll Owe

Employee Stock Option Tax Calculator.

. The complete guide to employee stock option taxes. If youre a startup employee earning stock options its important to understand how your stock. How much are your stock options worth.

Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. The following calculator enables workers to see what their stock options are likely to be valued at for a range. Your company-issued employee stock options may not be in-the-money today but assuming an investment growth rate may be worth some money in the future.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Use this calculator to help. The wage base is 142800 in 2021 and 147000 in 2022.

An employee stock option ESO is a stock option granted to specified employees of a company. For Private and Public Companies Who Want Equity Plans Done Right. Employee Stock Option - ESO.

Just follow the 5 easy steps below. Please enter your option information below to see your potential savings. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

Please enter your option information below to see your potential savings. Taxes for Non-Qualified Stock Options. Lets say you got a grant price of 20 per share but when you exercise your.

If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the option or when you. In particular the new rules limit the annual benefit on. The Employee Stock Options Calculator.

4 HI hospital insurance or Medicare is 145 on all earned. The Stock Calculator is very simple to use. In particular the new rules limit the annual benefit on.

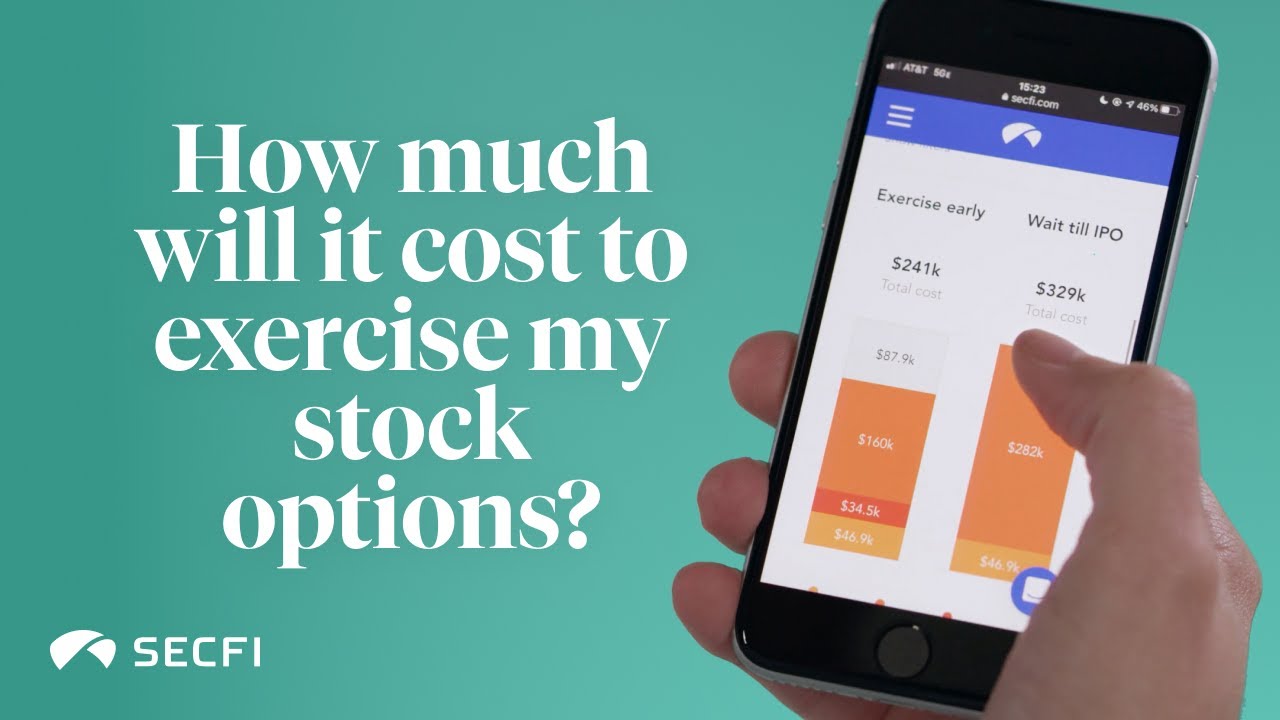

Click to follow the link and save it to your Favorites so. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. According to the calculator at the end of five years 500 shares of stock will be worth 13224. Enter the number of shares purchased.

This permalink creates a unique url for this online calculator with your saved information. Employee Stock Option Calculator for Startups Established Companies. Exercising your non-qualified stock options triggers a tax.

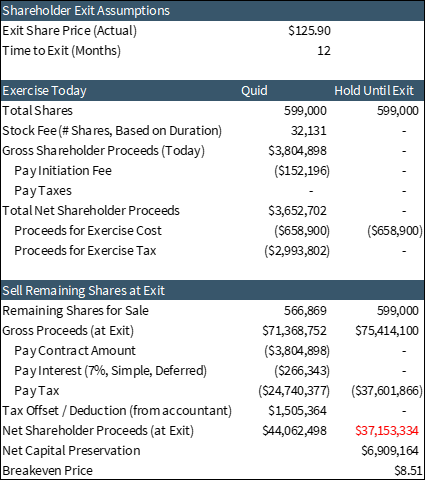

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Subtracting the 10000 it would cost to exercise the options shows a pre-tax. Its 62 on earnings up to the taxable wage base limit.

If youd like to estimate your taxes at exercise check out secfis stock option. For use with Non-Qualified Stock Option Plans. Enter the purchase price per share the selling price per share.

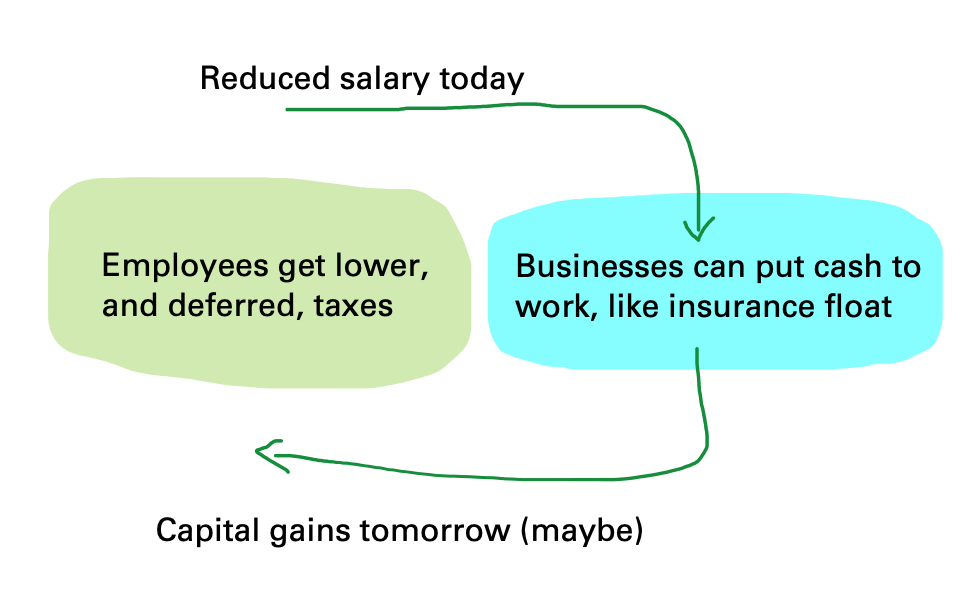

On this page is a non-qualified stock option or NSO calculator. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. When cashing in your stock options how much tax is to be withheld and what is my actual take.

Its 62 on earnings up to the taxable wage base limit. Option Exercise CalculatorThis calculator illustrates the tax benefits of exercising your stock options before IPO. This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Years until option expiration date 0 to 20 Total number. Stock Options Calculator for Employee Stock Option Valuation.

Sign up to calculate exercise costs. This tax insights discusses the new employee stock option rules and answers some common questions on the topic. For Private and Public Companies Who Want Equity Plans Done Right.

On this page is an Incentive Stock Options or ISO calculator. The Stock Option Plan specifies the total number of shares in the option pool. ESOs offer the options holder the right to buy a.

Stock Options Calculator To Forecast Future Value Of Eso S

Stock Options To Qualify Or Not To Qualify That Is The Question Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

Stock Options 101 The Essentials Mystockoptions Com

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Dentons Upcoming Changes To The Taxation Of Certain Employee Stock Options

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Employee Stock Options Free Money Kinda

Calculating Diluted Earnings Per Share The Motley Fool

Stock Option Financing In Pre Ipo Companies

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

521 Employee Stock Options Stock Photos Pictures Royalty Free Images Istock

Secfi Stock Option Tax Calculator

How Does Alternative Minimum Tax Amt Impact Exercising My Stock Options

How To Grant Stock Options To Foreign Employees

:max_bytes(150000):strip_icc()/GettyImages-869465668-5c41483646e0fb00018d6829.jpg)